Most of us think of a “Tenant” as a person who rents from a landlord and has permission to use the property. So let’s think of “Tenancy” as owning and using the property.

Most of us think of a “Tenant” as a person who rents from a landlord and has permission to use the property. So let’s think of “Tenancy” as owning and using the property.

If it’s just you, then tenancy can be listed as simply as Sole Ownership. If it’s more than one person, a title company will ask how you want to take title? You will be given the options of Tenants In Common, Joint Tenants, or Tenants by The Entireties.

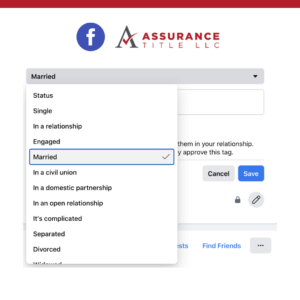

One way to look at it is to compare tenancy to your “relationship status” on Facebook. If you’re married, that’s “Tenants by the Entireties.” That’s an easy one.

If you’re “In a Relationship,” you could go for “Joint Tenants.” But what about if “It’s Complicated”? Got that covered, too. That’s “Tenants in Common.”

So why does any of this matter? It basically comes down to the question of “What do you want to happen to the property when you die?” It’s called “Right of Survivorship.” Not exactly fun stuff to think about, but it absolutely is something you need to think about.

Here’s how it works for each of these designations.

Sole Owner

If a property is owned by a single person, then that person can designate who will inherit the property when they die. Typically, that’s done through a last will and testament. If the owner has not designated a person to inherent the property, that gets a little more tricky … and that’s a blog for another day.

Tenants by the Entireties

You’re married, so in the state of Maryland this one is pretty simple. When one of the owner’s passes away, the surviving spouse will automatically assume full ownership.

Joint Tenants

Joint tenancy includes the right of survivorship in the state of Maryland, however, when you take the title it must be explicitly stated as “joint tenancy with right of survivorship.” There are other sticking points, too. For example, both tenants must own an equal share in the property and must acquire it at the same time.

Tenants in Common

This is that “It’s Complicated” option. It’s important to note that there is no right of survivorship for tenants in common. A property could be owned by two or more people, and their interest in the property does not have to be equal. If one owner dies, their interest in the property will go to that person’s designated heirs, rather than automatically to the other owners.

So if you’re about to purchase property, you need to know your situation and your options when you take the title. No one likes to think about their own death, but owning property is a big responsibility, and that means planning ahead. Even when it’s complicated.